Journal Entry For Mileage Expense . Web if you would like to track owners' miles as an mileage expense account, you can do so by using personal. Web i understand the importance of converting your mileage to expenses so that you have all the necessary information to. Web with the actual expense method, the system calculates and deducts the amount you spent using your car for. Web the journal entry is debiting “mileage expense” and crediting “owner’s equity.” this captures the expense for tax. Web when you prepare a journal entry for an expense, there are two steps: Web here we’ll go over what exactly accrued expenses are, how to account for them using journal entries, and what they mean for. First, you debit the relevant expense account, which.

from db-excel.com

Web if you would like to track owners' miles as an mileage expense account, you can do so by using personal. Web the journal entry is debiting “mileage expense” and crediting “owner’s equity.” this captures the expense for tax. Web with the actual expense method, the system calculates and deducts the amount you spent using your car for. Web here we’ll go over what exactly accrued expenses are, how to account for them using journal entries, and what they mean for. First, you debit the relevant expense account, which. Web i understand the importance of converting your mileage to expenses so that you have all the necessary information to. Web when you prepare a journal entry for an expense, there are two steps:

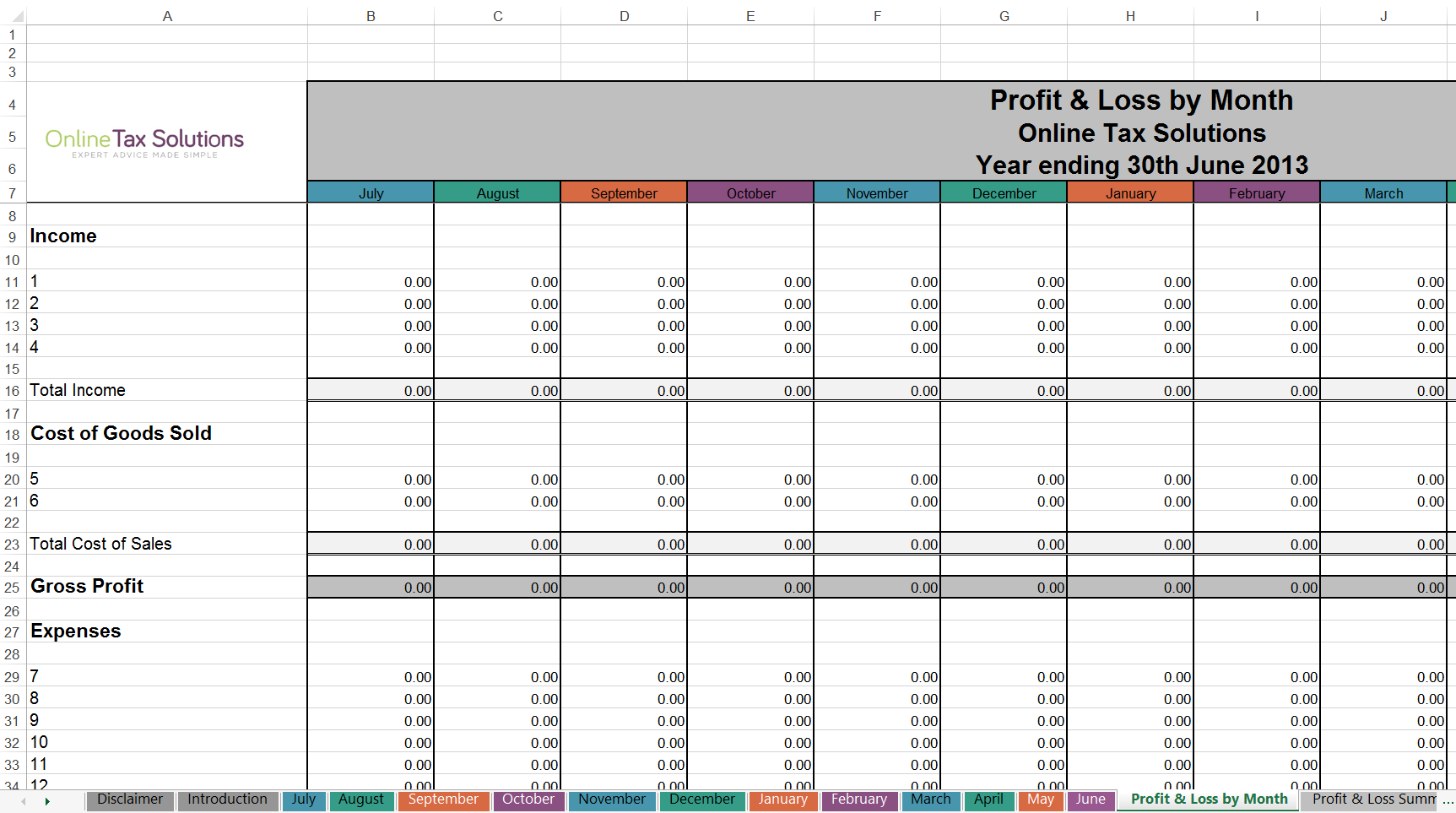

Journal Entry Template in Excel —

Journal Entry For Mileage Expense Web if you would like to track owners' miles as an mileage expense account, you can do so by using personal. Web here we’ll go over what exactly accrued expenses are, how to account for them using journal entries, and what they mean for. First, you debit the relevant expense account, which. Web i understand the importance of converting your mileage to expenses so that you have all the necessary information to. Web when you prepare a journal entry for an expense, there are two steps: Web the journal entry is debiting “mileage expense” and crediting “owner’s equity.” this captures the expense for tax. Web with the actual expense method, the system calculates and deducts the amount you spent using your car for. Web if you would like to track owners' miles as an mileage expense account, you can do so by using personal.

From www.etsy.com

Printable Fuel Log Tracker, Gas Tracker Printable, Gas Price Tracker Journal Entry For Mileage Expense Web the journal entry is debiting “mileage expense” and crediting “owner’s equity.” this captures the expense for tax. Web here we’ll go over what exactly accrued expenses are, how to account for them using journal entries, and what they mean for. Web with the actual expense method, the system calculates and deducts the amount you spent using your car for.. Journal Entry For Mileage Expense.

From templatelab.com

20 Printable Mileage Log Templates (Free) ᐅ TemplateLab Journal Entry For Mileage Expense First, you debit the relevant expense account, which. Web i understand the importance of converting your mileage to expenses so that you have all the necessary information to. Web here we’ll go over what exactly accrued expenses are, how to account for them using journal entries, and what they mean for. Web with the actual expense method, the system calculates. Journal Entry For Mileage Expense.

From www.chegg.com

Solved Kiona Co. set up a petty cash fund for payments of Journal Entry For Mileage Expense Web here we’ll go over what exactly accrued expenses are, how to account for them using journal entries, and what they mean for. Web the journal entry is debiting “mileage expense” and crediting “owner’s equity.” this captures the expense for tax. Web when you prepare a journal entry for an expense, there are two steps: Web with the actual expense. Journal Entry For Mileage Expense.

From www.double-entry-bookkeeping.com

Reimbursed Employee Expenses Journal Double Entry Bookkeeping Journal Entry For Mileage Expense Web with the actual expense method, the system calculates and deducts the amount you spent using your car for. First, you debit the relevant expense account, which. Web when you prepare a journal entry for an expense, there are two steps: Web the journal entry is debiting “mileage expense” and crediting “owner’s equity.” this captures the expense for tax. Web. Journal Entry For Mileage Expense.

From www.chegg.com

Solved Nguyen Co. set up a petty cash fund for payments of Journal Entry For Mileage Expense Web with the actual expense method, the system calculates and deducts the amount you spent using your car for. Web here we’ll go over what exactly accrued expenses are, how to account for them using journal entries, and what they mean for. Web the journal entry is debiting “mileage expense” and crediting “owner’s equity.” this captures the expense for tax.. Journal Entry For Mileage Expense.

From aflyertemplate.blogspot.com

Journal Entry Excel Template Flyer Template Journal Entry For Mileage Expense First, you debit the relevant expense account, which. Web i understand the importance of converting your mileage to expenses so that you have all the necessary information to. Web here we’ll go over what exactly accrued expenses are, how to account for them using journal entries, and what they mean for. Web the journal entry is debiting “mileage expense” and. Journal Entry For Mileage Expense.

From save.pejuang.net

Gas Mileage Expense Report Template Best Creative Templates Journal Entry For Mileage Expense Web with the actual expense method, the system calculates and deducts the amount you spent using your car for. Web i understand the importance of converting your mileage to expenses so that you have all the necessary information to. First, you debit the relevant expense account, which. Web here we’ll go over what exactly accrued expenses are, how to account. Journal Entry For Mileage Expense.

From www.coursehero.com

[Solved] Problem 83A Establishing, reimbursing, and increasing petty Journal Entry For Mileage Expense Web when you prepare a journal entry for an expense, there are two steps: Web here we’ll go over what exactly accrued expenses are, how to account for them using journal entries, and what they mean for. Web if you would like to track owners' miles as an mileage expense account, you can do so by using personal. First, you. Journal Entry For Mileage Expense.

From www.bartleby.com

Answered May 1 Prepared a company check for 350… bartleby Journal Entry For Mileage Expense Web with the actual expense method, the system calculates and deducts the amount you spent using your car for. Web i understand the importance of converting your mileage to expenses so that you have all the necessary information to. Web the journal entry is debiting “mileage expense” and crediting “owner’s equity.” this captures the expense for tax. Web if you. Journal Entry For Mileage Expense.

From www.chegg.com

Solved Kiona Co. set up a petty cash fund for payments of Journal Entry For Mileage Expense Web i understand the importance of converting your mileage to expenses so that you have all the necessary information to. Web if you would like to track owners' miles as an mileage expense account, you can do so by using personal. Web the journal entry is debiting “mileage expense” and crediting “owner’s equity.” this captures the expense for tax. Web. Journal Entry For Mileage Expense.

From www.pinterest.com

Download Medical Mileage Expense Form for Free Professional templates Journal Entry For Mileage Expense Web when you prepare a journal entry for an expense, there are two steps: Web with the actual expense method, the system calculates and deducts the amount you spent using your car for. First, you debit the relevant expense account, which. Web i understand the importance of converting your mileage to expenses so that you have all the necessary information. Journal Entry For Mileage Expense.

From www.chegg.com

Solved February 2 Wrote a 340 check to establish a petty Journal Entry For Mileage Expense Web i understand the importance of converting your mileage to expenses so that you have all the necessary information to. Web the journal entry is debiting “mileage expense” and crediting “owner’s equity.” this captures the expense for tax. Web if you would like to track owners' miles as an mileage expense account, you can do so by using personal. First,. Journal Entry For Mileage Expense.

From www.pinterest.com

Download the Business Mileage Tracking Log from Business Journal Entry For Mileage Expense First, you debit the relevant expense account, which. Web with the actual expense method, the system calculates and deducts the amount you spent using your car for. Web i understand the importance of converting your mileage to expenses so that you have all the necessary information to. Web if you would like to track owners' miles as an mileage expense. Journal Entry For Mileage Expense.

From lidaymelisenda.pages.dev

2024 Mileage Rates Gsa Freda Jillian Journal Entry For Mileage Expense Web here we’ll go over what exactly accrued expenses are, how to account for them using journal entries, and what they mean for. First, you debit the relevant expense account, which. Web with the actual expense method, the system calculates and deducts the amount you spent using your car for. Web if you would like to track owners' miles as. Journal Entry For Mileage Expense.

From db-excel.com

Journal Entry Template in Excel — Journal Entry For Mileage Expense Web if you would like to track owners' miles as an mileage expense account, you can do so by using personal. Web when you prepare a journal entry for an expense, there are two steps: First, you debit the relevant expense account, which. Web with the actual expense method, the system calculates and deducts the amount you spent using your. Journal Entry For Mileage Expense.

From www.chegg.com

Solved Palmona Co. establishes a 250 petty cash fund on Journal Entry For Mileage Expense Web when you prepare a journal entry for an expense, there are two steps: Web here we’ll go over what exactly accrued expenses are, how to account for them using journal entries, and what they mean for. Web with the actual expense method, the system calculates and deducts the amount you spent using your car for. First, you debit the. Journal Entry For Mileage Expense.

From www.chegg.com

Solved Nakashima Gallery had the following petty cash Journal Entry For Mileage Expense Web when you prepare a journal entry for an expense, there are two steps: Web the journal entry is debiting “mileage expense” and crediting “owner’s equity.” this captures the expense for tax. Web here we’ll go over what exactly accrued expenses are, how to account for them using journal entries, and what they mean for. Web with the actual expense. Journal Entry For Mileage Expense.

From amazon.com

ATAGLANCE Auto Mileage Log Record Book, 3.75 x 6.12 Journal Entry For Mileage Expense Web here we’ll go over what exactly accrued expenses are, how to account for them using journal entries, and what they mean for. Web with the actual expense method, the system calculates and deducts the amount you spent using your car for. Web if you would like to track owners' miles as an mileage expense account, you can do so. Journal Entry For Mileage Expense.